2025 will be a game-changing year for UAE businesses. The Federal Tax Authority (FTA) is simultaneously implementing nationwide e-invoicing legislation forcing all companies with a VAT registration to transition from paper or partially digital invoicing to an entirely automated, electronic structure. This diktat is part of broader digi-transformation efforts being pursued by the UAE government, […]

UAE’s E-Invoicing Initiative

The UAE government is advancing digital compliance with mandatory VAT e-invoicing in UAE 2025, overseen by FTA e-invoicing UAE. This initiative strengthens transparency, standardization, and efficiency in UAE B2B e-invoicing and tax e-invoicing UAE while reducing manual processes. Businesses must adopt structured VAT e-invoicing formats in the UAE for generating, validating, and transmitting invoices under UAE government e-invoicing requirements.

With digital invoicing UAE central to transformation, early adoption offers key benefits. By connecting via the Peppol access point UAE, companies achieve Peppol compliance UAE, simplify cross-border e-invoicing in UAE, enhance invoice automation UAE, and improve reporting. Supported by approved e-invoicing solution providers in the UAE, both SMEs and enterprises gain the advantages of VAT e-invoicing for SMEs UAE, faster payments, and lasting benefits of e-invoicing compliance in UAE.

How Advintek Simplifies E-Invoicing in UAE

More efficient compliance

Easier to use

Successful e-Invoice submissions

Errors eliminated

Industry Served:

Powering Malaysia’s e-Invoicing Evolution

We work with some of Malaysia’s most established and fast-growing companies. Whether you're in healthcare, logistics, technology, or manufacturing chances are, we’re already powering your industry.

10+ Years

3000+ Clients

70+ Industries

CMMI Lvl 3

ISO 27001:2022 Certified

Learn why Advintek is the right choice for you

Built for Malaysian SMEs

Tailored for all sized Malaysian businesses to achieve fast e-Invoice compliance, without complex ERP systems.

LHDN-Compliant & Secure

Fully aligned with LHDN’s latest e-Invoice rules.

Flexible Submission Methods

Submit e-Invoices using API, MyInvois portal, or Excel templates—whichever suits your operations best.

Seamless Integrated

Generate and validate e-Invoices directly inside QuickBooks, Xero, MYOB.

Real-Time Dashboard

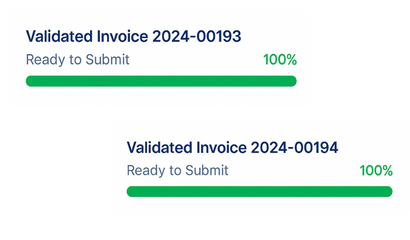

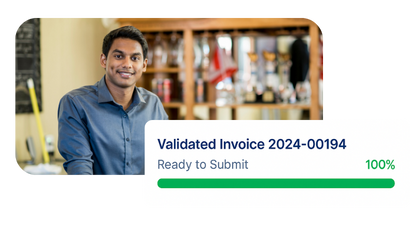

Monitor invoice status, validations, & rejections instantly.

Fast, Guided Onboarding

Go live in hours, not weeks, with our local support.

Timeline of E-Invoicing Adoption in UAE

The UAE is implementing mandatory VAT e-invoicing starting in 2025 through a phased approach. Firms need to stay up-to-date in order to be completely compliant with FTA e-invoicing requirements of UAE and prepared for digital invoicing implementation of UAE.

Rollout Schedule:

Q4 2024:

Approved e-invoicing solution providers requirements and procedures are finalized for UAE.

Q2 2025:

Draft e-invoicing law of UAE released, specifying technical and compliance requirements.

Q2 2026:

Phase of mandatory B2B and B2G e-invoicing UAE begins.

Key Milestones:

11 July 2023:

Ministry of Finance announces five major digital transformation projects of which the E-Billing System is one.

14 February 2024:

MoF sets out detailed plans for the UAE e-invoicing system.

2 October 2024:

MoF launches the e-invoicing portal UAE and releases business guidelines.

30 October 2024:

National VAT law amendments released in the Official Gazette of the UAE with provisions for e-invoicing.

6 February 2025:

MoF initiates public consultation on e-invoicing of the data requirements of the UAE.

Choose the perfect plan for you needs

- Secure wallet storage

- Real-time portfolio tracking

- Basic transaction history

- Limited security features

- Email support

- Secure wallet storage

- Advanced portfolio analytics

- Detailed transaction history

- Limited security features

- 24/7 priority email support

- All features from the Basic Plan

- Advanced portfolio analytics

- Detailed transaction history

- Enhanced security measures

- 24/7 priority email support

Why Choose Advintek

FTA Aligned

We are a UAE-licensed e-invoicing solution provider, fully FTA e-invoicing norm and requirement-compliant.

ISO 27001 Certified

Protect your digital invoicing UAE processes with ISO 27001-compliant cloud infrastructure and state-of-the-art data protection.

Peppol Certified Access Point

Integrate effortlessly with the Peppol access point UAE and carry out B2B e-invoicing transactions securely and reliably.

Local Expertise

Our UAE-based team provides hands-on guidance regarding FTA e-invoicing UAE compliance.

SME-Friendly Solutions

We offer adaptable, economical plans designed to enable e-invoicing adoption and automation by UAE SMEs.

Enterprise Integration

Integrate seamlessly with ERP systems using APIs and tools that enable invoice automation at scale in the UAE.

Trusted by growing businesses across Malaysia

Excellent

4.8

Rated 4.8 out of 5 from 3,614 customer reviews.

Everything You Need to Know

What is mandatory e-invoicing in UAE 2025?

It requires all VAT-registered businesses to adopt FTA-compliant digital invoicing UAE aligned with e-invoicing standards.

How do I comply with FTA/ZATCA e-invoicing in UAE?

You must onboard through an approved e-invoicing solution provider UAE like Advintek for automation, validation, and Peppol compliance UAE.

What are the benefits of e-invoicing compliance in UAE?

It ensures faster payments, fewer errors, tax compliance, and simplified cross-border e-invoicing UAE transactions.

What is the cost of e-invoicing in UAE?

The cost of e-invoicing in UAE varies based on company size and volume. Advintek offers scalable plans for SMEs and enterprises.

Do SMEs need to adopt VAT e-invoicing in UAE?

Yes, under the mandatory VAT e-invoicing UAE 2025, SMEs must comply, gaining efficiency and automation benefits.

How does Peppol onboarding UAE work?

Advintek provides a step-by-step e-invoicing guide UAE, ensuring smooth registration and connectivity to the Peppol network.

What are the UAE government e-invoicing requirements?

Businesses must comply with FTA e-invoicing in the UAE regulations, including structured invoice formats, digital transmission, and invoice automation UAE.

Can I automate UAE B2B e-invoicing?

Yes, digital invoicing UAE solutions allow automated B2B workflows, improving accuracy, speed, and compliance.

What are the advantages of VAT e-invoicing for SMEs in UAE?

SMEs benefit from faster payments, reduced errors, simplified reporting, and improved tax e-invoicing UAE compliance.

How does Advintek support digital transformation e-invoicing UAE?

We enable businesses to implement invoice automation UAE, integrate ERP systems, and adopt Peppol e-invoicing UAE for full digital compliance.

Explore the Latest E-Invoicing Updates

The world of tax and compliance is changing fast. Governments are abandoning traditional manual invoice closure processes for real time, e-invoicing to drive improved tax collection, transparency and overall business efficiency. In the United Arab Emirates, the Federal Tax Authority (FTA) is introducing an e-invoicing mandate in 2025—a shift that will affect businesses small and […]

1 September 2025 onwards, the Inland Revenue Board of Malaysia (LHDN/IRBM) will impose interesting e-Invoicing requirements for invoice issuance in foreign currencies. Among these requirements, the issuance of invoices with MYR-equivalent values, using any approved currency exchange rate, is mandatory. This is beyond an update of existing procedural guidelines and is in line with the […]

Mergers and acquisitions (M&As) throughout Malaysia are picking up tempo because companies are looking for strategic growth opportunities, access to new markets, and digitalization. But with the usual taxation, valuation, and legal hurdles, one new element has become inseparable mandatory e-invoicing throughout Malaysia. By 2025, it is required by the Inland Revenue Board of Malaysia […]

Malaysia’s tax landscape is entering a new phase because two major initiatives will be launched in 2026: the self-assessment stamp duty system in line with the Stamp Act Malaysia and the expansion of the Sales and Service Tax (SST Malaysia). They both bring a new direction toward a higher level of taxpayer accountability and broader […]

You already know that the MyInvois mandate is reshaping how Malaysian businesses handle invoices. What most don’t realize until they’re in the thick of it is how much operational weight this shift adds to your team. Complying with e-Invoicing requirements isn’t as simple as uploading a file. It means understanding technical schemas, tax metadata, PEPPOL […]